Over the last decade, "clean beauty" has evolved from a niche wellness trend into a fundamental shift in the market, driven by informed consumers who increasingly scrutinize ingredient lists and demand transparency from brands. Today, more than three in four consumers actively seek beauty & skincare products manufactured with natural ingredients and sustainable practices.

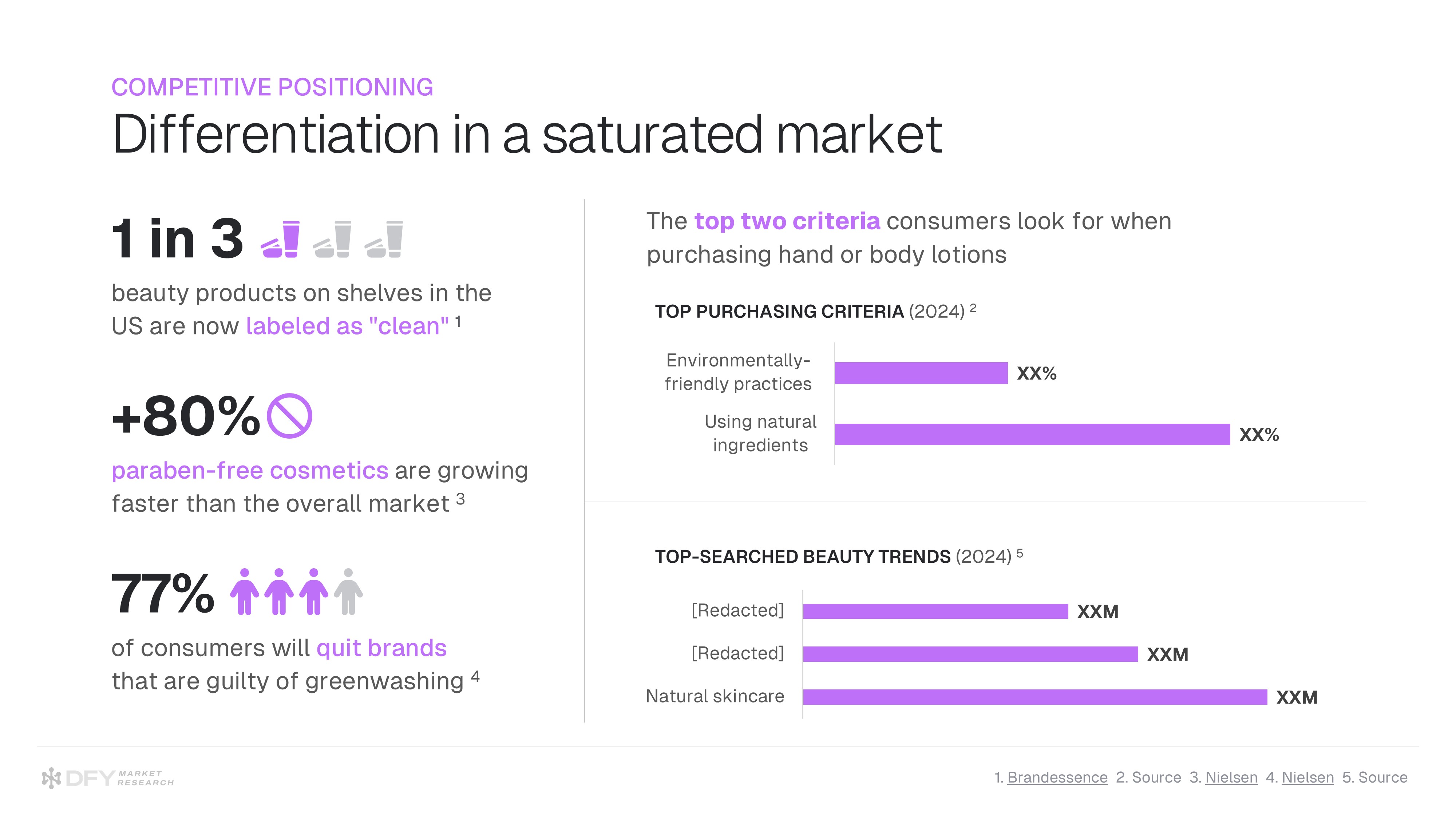

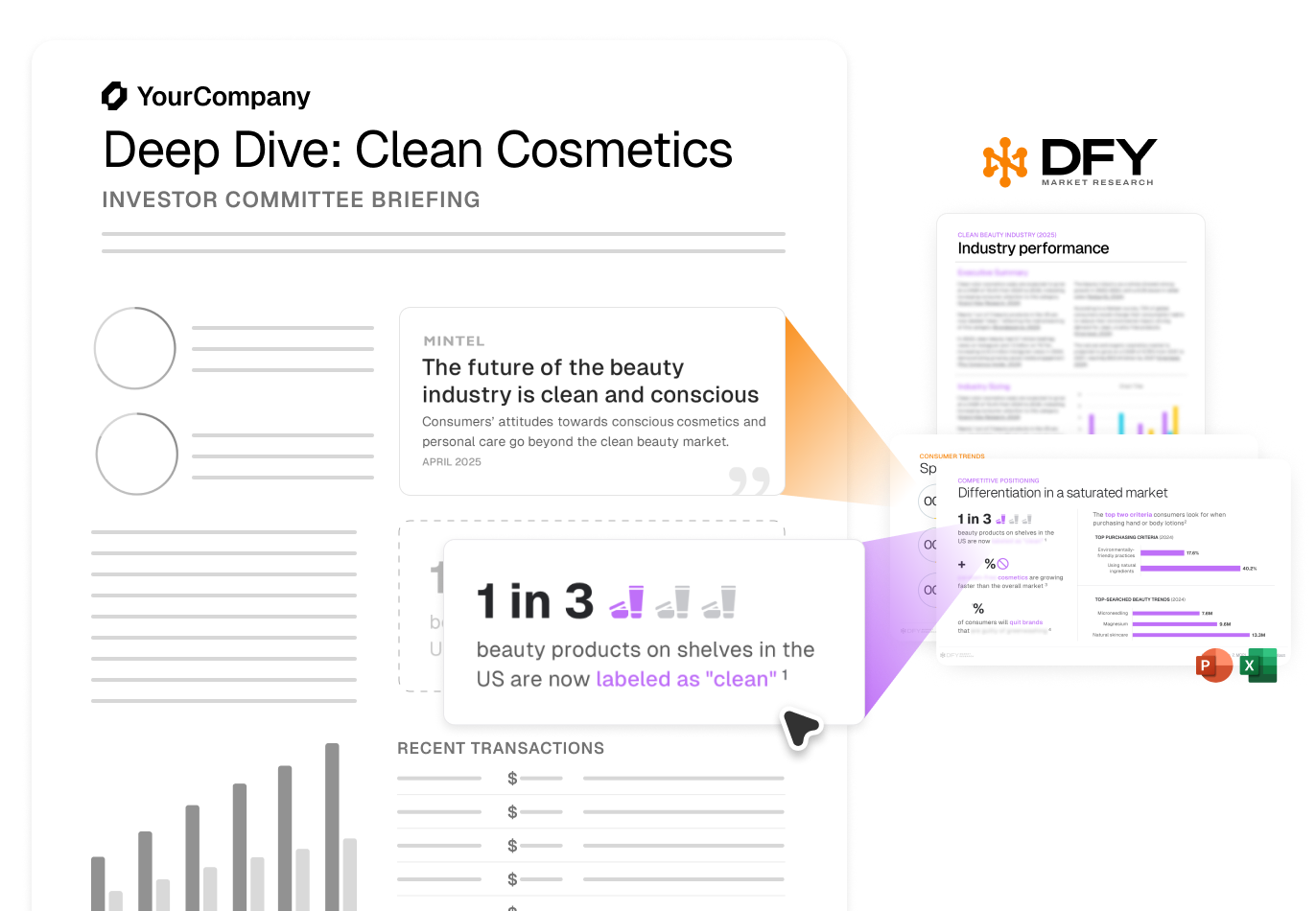

However, this burgeoning niche now faces a critical inflection point. With one in three beauty products now labeled as "clean," differentiation has become increasingly challenging. Success in today's market demands accessible ingredient science education, authentic brand values, and strategic positioning that goes beyond marketing claims to deliver proven results.

In this report, our analysts examine the dynamics reshaping the beauty industry, identifying opportunities for brands to capture market share in this competitive, high-margin segment.

Highlights

- Paraben-free cosmetics are growing 80% faster than the overall market

- Rising skepticism across markets: XX% of America consumers trust clean beauty claims and only one in XX German consumers agree traditional cosmetics offer better results

- Clean beauty reached 7.3M posts on Instagram (+X%) and 2.1B views on TikTok (++XX%)

- Clean beauty brands command XX% higher margins than conventional competitors

Generational preferences have driven exponential growth

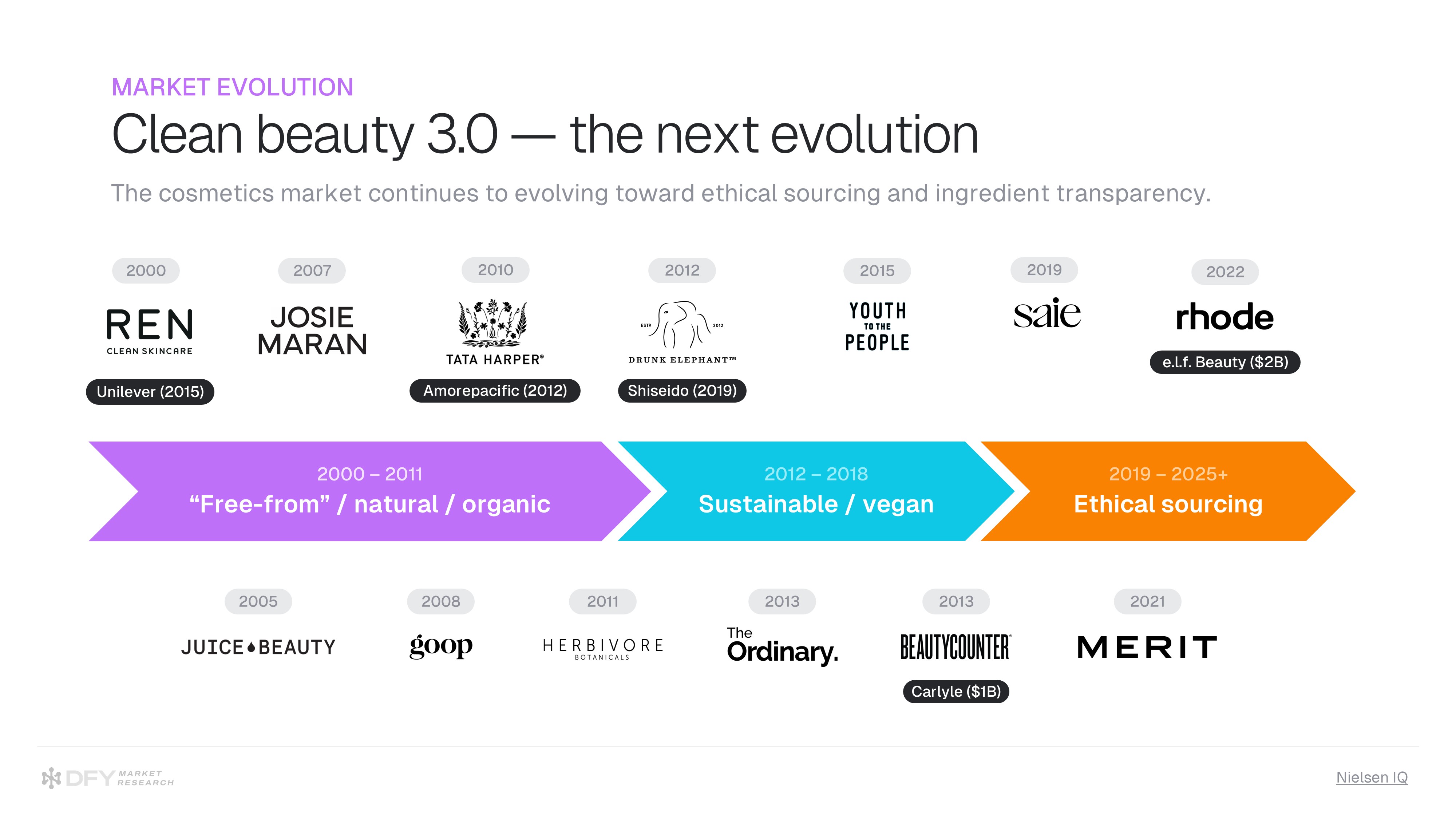

The clean beauty category initially emerged in the 80's with brands like Aveda and Origins introducing natural formulations with some of the first "free-from" claims in the cosmetics market. Incumbents have traditionally acquired innovation in this space (rather than building internally), producing notable exits like Drunk Elephant (acq. Shiseido) and The Ordinary/Deciem (acq. Estée Lauder). Clean beauty went mainstream around 2015, expanding into the mass-market segment (while still commanding premium pricing) as consumers became more ingredient-conscious and sought transparency in formulations amid growing concerns about potentially harmful chemicals in traditional cosmetics.

Millennials (now in their peak earning years) and Gen Z have been the leading contributors to the dramatic growth in the clean beauty segment over the last decade. Clean cosmetic sales grew XX% from 2020 to 2025, compared to XX% from 2015 to 2020. For younger consumers, clean beauty is part of a broader lifestyle choice, integrating a preference of natural and organic products with broader values regarding the environmental, wellness, and ethical consumption. This cohort demonstrates higher price tolerance but demands authentic brand narratives and supply chain transparency.

Greenwashing controversy and consumer skepticism

The saturation of the clean beauty industry has created market fatigue, where some consumers are switching back to traditional products due to skepticism around sustainability claims and product efficacy. To stand out in this environment, brands have invested heavily in third-party certifications, clinical testing, transparent supply chain documentation, and user-generated content (UGC). The winners distinguish themselves through measurable commitments to clean formulations and sustainable practices that consumers can independently verify.

There is still no standardized definition of "clean" beauty, and consumer attitudes vary widely across geographies. Whereas regions like XX associate the term "clean" with "green" environmentally-friendly products, consumers in XX interpret it as “free-from” formulations. The regulatory environment remains highly fragmented, with wide variations in banned ingredients around the world (just 11 cosmetics ingredients banned in the US vs. thousands in Korea and the EU). This creates opportunities for global brands that can establish clear, defensible differentiation in their claims to build stronger consumer trust and command pricing premiums.

| Country/Region | Banned Ingredients |

|---|---|

| European Union | 1,600+ |

| Korea (MFDS) | 1,000+ |

| Canada | 500 |

| Japan | 100+ |

| Australia | 90+ |

| China | 80+ |

| Brazil | 50+ |

| United States | 11 |

Digital channels dominate discovery and education

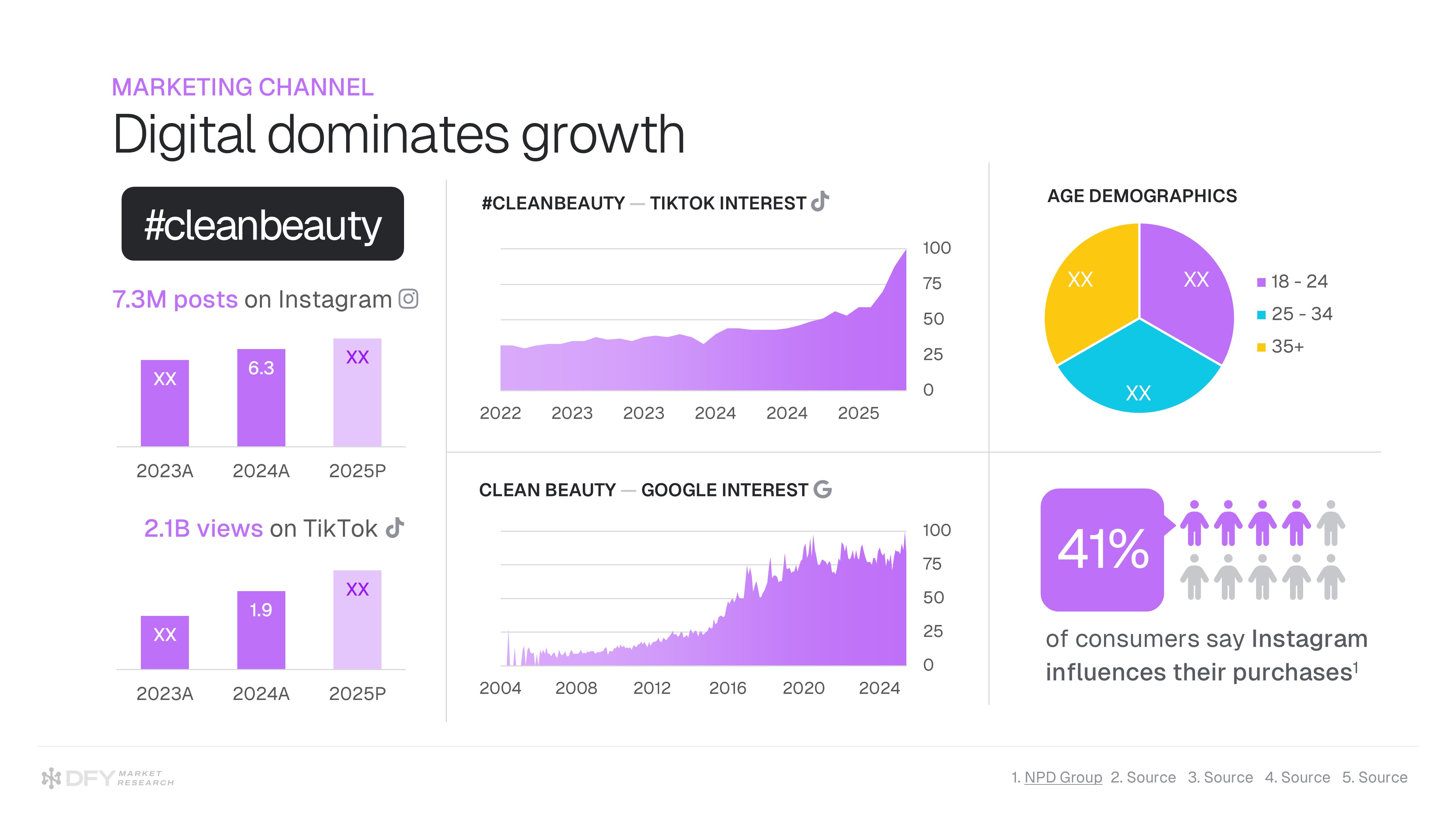

The generational shift to "clean" consumer products extends beyond product preferences to product messaging and marketing. Younger consumers discover and research products primarily through digital channels, with an emphasis of social proof and peer recommendations over celebrity endorsements. Clean beauty reached 7.3M posts on Instagram in 2024 (+X% year-over-year) and 2.1B views on TikTok (+XX% year-over-year).

For clean beauty buyers, social media serves as both a product discovery engine and third-party verification platform, where product claims face deep scrutiny from informed audiences and critical reviewers. This has fostered a growing ancillary market of nearly XX,XXX micro-influencers specializing in creating skincare user-generated content (UGC).

eCommerce accounts for XX% of total clean beauty sales, still lagging in-store purchases. Digital-native brands benefit from lower customer acquisition costs by leveraging direct-to-consumer (DTC) channels to educate consumers and build trust.